Kelley Pyles discusses her approach to helping clients create a savings plan that makes sense for a successful future. Social Security is a necessary part of a comprehensive retirement income strategy; there are important considerations before claiming early. Working with a financial professional is crucial in coordinating three types of benefits. Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-kelley-c-pyles-cfp-certified-long-term-care-specialist-with-royal-fund-management/ Pyles says, “By combining the proper social security claiming strategy, the judicial use of annuities within qualified plans, and other financial instruments, a synergistic effect can be created.…

Read MoreCategory: Finance

Josh D. Millang, President of Retirement Protectors Discussing How Taxes Impact Retirement, Interviewed on Influential Entrepreneurs Podcast

Josh Millang discusses how taxes impact retirement. Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-josh-d-millang-president-of-retirement-protectors-discussing-how-taxes-impact-retirement/ Taxes are a significant factor to consider when creating a retirement plan. Paying taxes on income can significantly reduce the amount of money available for retirement savings. It is essential to understand how taxes can impact people’s plans and make adjustments accordingly. Josh said: “By being aware of the tax implications, people can make more informed financial decisions that will help them reach their retirement goals more quickly. Knowing the types of…

Read MoreJosh D. Millang, President of Retirement Protectors Discussing How Social Security Claiming Impacts Retirement, Interviewed on Influential Entrepreneurs Podcast

Josh Millang discusses how social security claiming impact retirement. Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-josh-d-millang-president-of-retirement-protectors-discussing-how-social-security-claiming-impacts-retirement/ When deciding when to claim Social Security, it is crucial to understand the impact that this decision will have on retirement. Different claiming strategies, such as delaying or changing benefits, may affect the total lifetime Social Security benefit and other aspects of retirement income. If someone is married, their spouse’s benefit is also impacted by them claiming Social Security. If one spouse dies before the other does, the survivor can…

Read MoreTom Rutkowski, President of Innovative Retirement Strategies Discussing Using Life Insurance for Retirement Planning, Interviewed on Influential Entrepreneurs Podcast

Tom Rutkowski discusses using life insurance for retirement planning. Questions covered in this interview include: Why choose Life Insurance instead of annuities or other assets? Are these policies the same as I might use to insure my spouse? Does it take years to accumulate cash value in a whole life policy, and is the return on life insurance low relative to other investments Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-tom-rutkowski-president-of-innovative-retirement-strategies-discussing-using-life-insurance-for-retirement-planning/ Life insurance is an invaluable tool for retirement planning. With life insurance, people can ensure that…

Read MoreMark MacDonald, President of Physicians Financial Health, Interviewed on the Influential Entrepreneurs Podcast Discussing Tax Mitigation Strategies

Mark MacDonald discusses how Physicians and other high income, and net worth individuals can take control of their taxes by utilizing tax-incentives inside the IRS tax code. In the interview, Mr. MacDonald discusses how Physicians and other high income, and high net worth individuals can reduce taxes on their current and future income, investments and estates utilizing a variety of tax-advantaged and tax-free strategies and products. One very popular strategy involves cash-value life insurance utilizing tax code 7702 and 72(e). Other popular IRS tax advantaged opportunities include well known tax…

Read MoreShaun Clearwater, CEO of Aspen Creek Financial, Interviewed on the Influential Entrepreneurs Podcast Discussing Tax Mitigation Strategies

In this interview, Shaun Discusses His Approach to Helping His Clients with Financial Planning and Retirement Using Life Insurance. Because deferring taxes is not better than paying taxes now, he feels that placing money into a specialized account in a permanent life insurance policy provides spectacular benefits. This provides liquidity so one can access their funds while also providing tax-free growth. This guarantees no loss of principal and a dramatic upside in cash value growth inside the policy. Questions covered in the interview include: Can retirement savings be passed to…

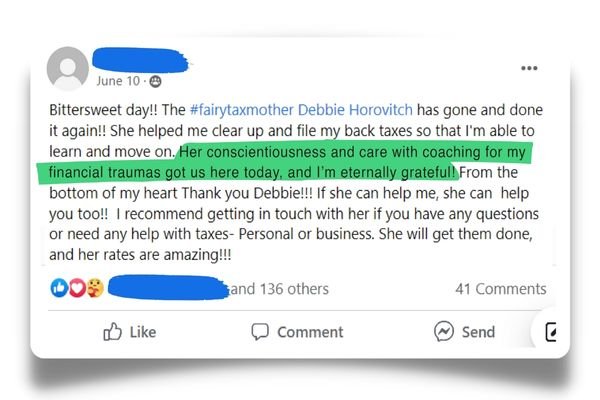

Read MoreCanada’s Tax Fairy Godmother Uniquely Qualified To Understand The Money Fears Of Canadians With Ten Years Of Unfiled Tax Returns, Self-Employed, And ADHD or CRA Anxiety

It’s surprisingly common in Canada for people to fall ten or more years behind on filing their taxes, according to Debbie Horovitch, a virtual tax professional based in Toronto, who has worked with more than 300 people in two years.

Read MoreKevin Harrington and Scott Keffer Launch their Latest Book, Retire Like a Shark, Featuring Insights from 36 Retirement Experts, on November 16, 2022

Retire Like a Shark, which will launch on November 16, 2022, offers insights from 36 of North America’s leading business, financial, and investment authorities on the best retirement strategies in these uncertain times.

Read MoreBerj Arakelian, Area Sales Manager with CMG Home Loans, Interviewed on the Influential Entrepreneurs Podcast, Discussing Unique Loan Options for Investors

Berj Arakelian discusses loan options for real estate investors. Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-berj-arakelian-area-sales-manager-with-cmg-home-loans-discussing-unique-loan-options-for-investors/ A few different types of mortgage loan options are available to real estate investors. The most common type of loan is the conventional mortgage loan, typically used to purchase primary residences. However, investment property loans are also available for those looking to buy rental properties or other investment properties. Berj shared: “The biggest difference between investment property loans and primary conventional mortgages is the down payment requirements. Conventional mortgages for…

Read MoreAndrew Carrillo, President and Founder of Barnett Capital Advisors, Interviewed on the Influential Entrepreneurs Podcast, Discussing Asset Allocation in Retirement Portfolios

Andrew Carrillo discusses the importance of working with a financial planner who is a fiduciary. Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-andrew-carrillo-president-and-founder-of-barnett-capital-advisors-discussing-asset-allocation-in-retirement-portfolios/ Asset allocation is one of the most important decisions that investors make; it is also one of the most difficult. Asset allocation involves dividing an investment portfolio among asset classes, such as stocks, bonds, and cash. The percentage of each asset class in the portfolio depends on the investor’s goals, risk tolerance, and time horizon. The goal of asset allocation is to diversify investments and…

Read More